W-8BEN-E

W-8BEN-E

Among the self-employed and business owners who are currently doing business, some of them may have been asked to fill out W-8BEN-E while doing business with an American company. If it's not your first time, you know how and what information you need to enter, but I prepared it for those who are embarrassed when they are asked to write it for the first time.

What is W-8BEN-E??

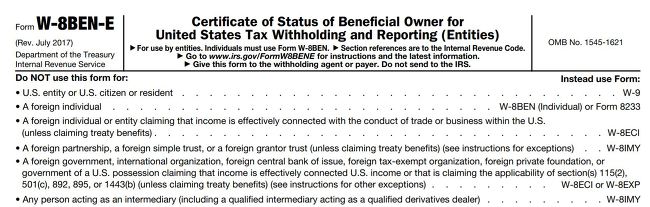

If you look at the form, it states "Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)." In other words, "Proof of beneficiary status for U.S. tax withholding and reporting." After W-8BEN, E stands for Entity and must complete this form if it is a corporation. If you are an individual or a different type of company, you can fill out another form. If you submit this form, it will not be withheld from the United States. If you haven't submitted it, up to 30% of the tax can be paid. You must also complete this form under the Foreign Account Tax Compliance Act (FATCA) Foreign Account Tax Compliance Act (FATCA).

How to complete W-8BEN-E

Let's take a look at one by one. For general corporations, you can write Part I, Part III, Part XXV or Part XXVI and Part XXXX.

Part I

First, see the description.

Now, it's part I. Now you have to fill out all the documents in English. First, write your corporate name in English. Then, write your country in number 2 and check with the corporation if you are a corporation in number 4.

If money is coming from the United States, for example, through trade, check on "Active NFFE. Complete Part XXV." If you invest in a U.S. corporation and receive dividends, for example, check on "Passive NFFE. Complete Part XXVI."

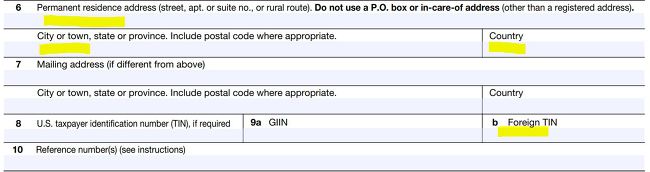

You can fill out the address of your corporation in No. 6 and fill out the business registration number in the last 9b.

Part III

Next is Part III. Check 14 a. and write your country in the blank, check 14 b. and check "Company with item that meet active trading or business test" if it means investing in a U.S. corporation and paying dividends, for example.

Part XXV or Part XXVI

For example, if money is coming in through trade, as checked with Part I, if you invest in a U.S. corporation and receive dividends, for example, you should check only Part XXVI.

Part XXX

Finally, sign, write your name, and date today in the signature box and check "I certify that I have the capacity to sign for the entity identified on line 1 of this form."

The way you fill out the form above may vary depending on the type of business (e.g., listed company) or which country you are a citizen of.

You need to know for sure and prepare thoroughly...

Whatever happens, it's embarrassing and time consuming at first, but once you go through it, it's really nothing. It's a very difficult time around the world, and I hope the information above will be beneficial to many self-employed/business owners.

That's all for today.

Relevant Post [Please click the link below]

- [USA/Business] - Establishment of Corporation in the U.S.

2020/10/29 - [USA/Business] - Establishment of Corporation in the U.S.

- [USA/Business] - The Way to Get a Free DUNS Number

2020/10/29 - [USA/Business] - The Way to Get a Free DUNS Number

- [USA/Business] - How to export items subject to FDA to the U.S.

How to export items subject to FDA to the U.S.

How to export items subject to FDA to the U.S. FDA If you are planning to sell your products to the U.S. market, and if you are informed that the products are subject to FDA review or need to be FD..

lifelessonv.tistory.com

'USA > Business' 카테고리의 다른 글

| The Way to Obtain EIN (Employer Identification Number) for Foreign Firms for Free via Phone (0) | 2021.08.03 |

|---|---|

| How to Export Baby Products to the U.S. (CPC Certificate) (0) | 2021.02.25 |

| How to export items subject to FDA to the U.S. (0) | 2021.02.25 |

| The Way to Get a Free DUNS Number (0) | 2020.10.29 |

| Establishment of Corporation in the U.S. (0) | 2020.10.29 |